Home Blog

Harvard Federal Credit Union Streamlines Member Experience with Unified Interaction Platform

Brings phone, digital interactions, and automation together for seamless member service

Signal Financial Elevates the Member and Employee Experience

Unifies call center and digital interactions in single platform for seamless member service

Celina Insurance Group Creates a Stand-out Agent Experience to Drive Agent...

Midwest mutual insurer scores near-perfect agent satisfaction with the launch of Glia

About Signal Celina

Community Bank Melds AI Self-Service with Human Touch

Glia Virtual Assistant & Digital Customer Service deliver significant service efficiencies

Financial Institutions Outperform M&A Integration Expectations

How they created efficiency, managed through the transition, AND improved the customer experience in the process

Experian Insurance Services Transforms its Sales and Service Experience with Digital...

Experian Insurance Services deployed Glia’s Digital Customer Service platform and a chatbot to reimagine online interactions

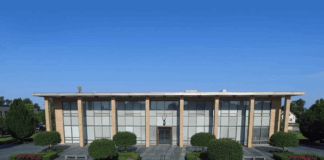

Bank of Guam Lays Foundation for its Future with Digital Transformation

Single interaction platform streamlines service options, enables seamless experience

State Fund Streamlines Workers’ Comp Application Process

Digital Transformation Puts Customers at the Heart of the Process

Community First’s Human-Centric Digital Strategy Fuels Rapid Growth

Personalized digital service puts members first and delivers strong ROI

Leading P&C Insurer Delivers Seamless Digital Experience Across 7 Business Units...

Fortune 100 Insurer has rolled out Glia’s Digital Customer Service (DCS) platform across sales, service, claims, billing and its agent portal to provide...