For insurance carriers, policyholder retention is intrinsically tied to the success of the business. The cost of acquiring a policyholder can be steep, and in order for that policyholder to become profitable for the carrier, they need to retain them for years to come.

LexisNexis research found it takes between three and seven years for a new auto insurance policy to reach the value of the average lost policy.

Insurance companies will inevitably lose some customers on price, particularly on products like auto insurance where shoppers tend to be especially price sensitive and can more easily shop for cheaper rates. It’s poor business to write policies at unsustainable rates, therefore some policyholder churn directly related to price is inevitable.

But what’s not inevitable is policyholder attrition due to service. With the right tools and the right people, carriers can positively impact policyholder retention rates by providing superior customer service. At Glia, we’re helping insurance companies improve policyholder satisfaction with Digital Customer Service (DCS).

Submitting a claim—the ultimate moment of truth

“Moments of truth” play a pivotal role in how a customer perceives a brand. Broadly speaking, these are the most important issues that customers experience—complex, critically important, time-sensitive, emotionally-impactful situations. When we consider the insurance customer experience, there’s certainly the moment of truth we all think about—filing a claim.

In insurance, claims are almost always where the rubber meets the road. Policyholders have been paying premiums time and time again with the understanding their insurance company will be there when they need them most.

It’s not a revelation that providing a good experience at the time of a claim is important for insurers. But how exactly does a carrier go about doing so? It starts the moment the policyholder is seeking to file their first notice of loss (FNOL). What does that experience look like?

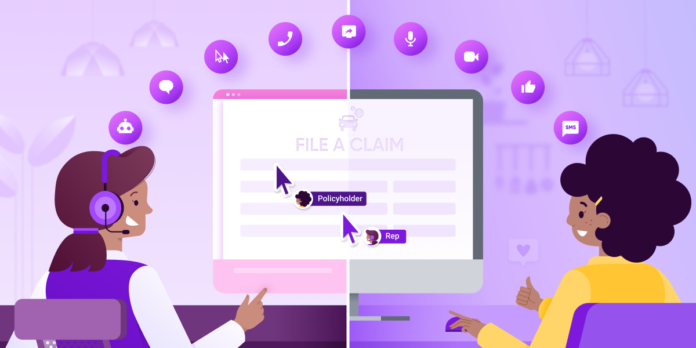

A policyholder may seek to inform their carrier in a few ways: contacting their agent, calling the carrier, or visiting the carrier’s website or mobile app to digitally submit the claim. In these final two instances, where the policyholder is going directly to the insurer, that first interaction is where carriers leveraging Digital Customer Service can deliver a positive experience.

By using collaboration tools, such as CoBrowsing, a carrier’s customer service reps can guide policyholders through the online FNOL form, ensuring accuracy and completeness that drives claims success. Carriers using DCS in their claims process have also seen a reduction in claim call times and the number of contacts needed per claim, both leading to increased customer satisfaction.

Imagine what this same scenario may look like without this type of interaction. A policyholder goes to the carrier’s website and begins filling out the FNOL form. They’re unsure of a few responses and try to call the customer service number on the website. They end up in a general queue with an estimated wait time of 20 minutes. Frustrated, they hang up and proceed to fill out the FNOL form as best they can. The inaccuracies, though, lead to a future phone tag to sort out the discrepancies in information, delaying the claim payment and resolution.

These are the moments of truth, the times when a policyholder may question whether the carrier is who they want to do business with. By empowering customer service reps with the right tools to engage policyholders on screen at their moment of need, these interactions can promote brand loyalty, not send them shopping.

Claims aren’t the only moment of truth in insurance

While claims may be the most important moment of truth in terms of avoiding policyholder churn, the insurance industry is unique in that interactions with policyholders are limited. As a result, nearly every interaction with policyholders should be viewed as a moment of truth.

If a client has an issue with their billing or needs to make a change to their policy, the seamlessness of that exchange will play a role in whether that policyholder opts to shop at renewal or they remain a customer.

Digital Customer Service enables carriers to improve policyholder retention by meeting customers where they are trying to resolve these issues—on screen. While many of these inquiries today may come in through phone calls, statistics show more than 80% of customers are on screen trying to resolve their issues through self service.

Instead of forcing customers to disconnect from the digital experience and prolong the interaction, carriers can provide options to chat or talk with OnScreen Voice or video right from their device.

Policyholder retention can be positively influenced by providing superior service at every interaction with policyholders—from a claim to a billing inquiry. Visit our insurance Digital Customer Service page to learn more about how Glia’s helping carriers reinvent how they serve customers.