Over the past decade, insurance companies have invested heavily in digital front-end systems to provide a better experience for their customers and agents. Yet, for the most part, the way those individuals interact with carriers when they need support has largely remained the same.

If a policyholder is online looking to pay their bill but has a question, they typically have to disengage from the digital experience and call a 1-800 number. When agents are reviewing their commissions and see an error, they’re most often left to send an email or also pick up the phone.

While the self-service experience has moved digital, the customer service experience has remained email and phone dominant.

For years, this made sense. If a policyholder or agent doesn’t have an online system to access and self-serve, there would be no need to offer support directly from those digital solutions.

But what about now? For carriers that have invested in digital self-service, the logical next step is to meet their customers where they are when they need assistance. As we discussed in one of our recent blogs, it’s these 2-way interactions that you have with your customers (where it’s “we” instead of “just me”) that comprise about 20% of all touch points with customers. And yet they’re responsible for upwards of 80% of the impact.

The benefits of improving these interactions doesn’t just show up in customer satisfaction scores or agent brand loyalty. Companies also see real savings associated with new-found efficiencies of a holistic, end-to-end interaction strategy.

Drive New Efficiency and Savings with Online Interactions

Think about the most common customer frustrations when it comes to interacting with a contact center. Things like having to re-explain your issue. Or being transferred to a new agent. Or being forced to switch to a new channel.

These disruptions not only all lead to an irritating customer experience, but they also cost the contact center more money. More time spent helping a customer, with more reps involved, all resulting in a poor customer experience.

By implementing a holistic interaction platform, insurance companies can improve KPIs such as first call resolution and average handle time, reducing operating costs while simultaneously providing a more efficient and effortless customer experience.

Offering Digital Customer Service solutions, such as chat, OnScreen Voice, and video, enables carriers to properly route incoming engagements to the right team, leveraging business logic based on the page the customer is visiting. For instance, if a claimant filing a First Notice of Loss (FNOL) begins a chat from the digital FNOL page, that interaction can be immediately routed to the claims team. Improving this routing by having the interaction begin where the customer is in their digital journey positively improves first contact resolution.

Engaging digitally has also been found to drive more efficient interactions. Because the policyholder or agent is often already logged in when they begin an interaction, there is no need to authenticate the individual at the beginning of the interaction. This alone can drive meaningful improvement to an organization’s average handle time.

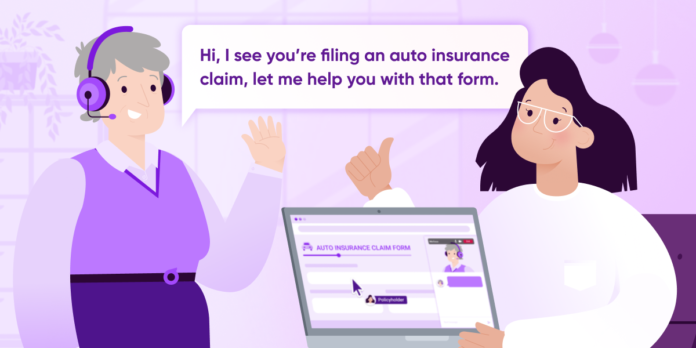

Other tools, such as Live Observation, which enable reps to get immediate visual context of where the policyholder or agent is in their digital journey when the interaction starts, allows reps to begin assisting the customer quicker. By starting the interaction literally on the same page as the customer, a rep is able to bypass generic questions like “how can I assist you today?” Instead, reps can be more direct, saying something like “I see you’re filing an auto insurance claim, let me help you with that form.” In doing so, contact centers simultaneously boost satisfaction and customer loyalty while significantly improving operational efficiency.

If you’ve invested in modernizing your front-end systems, the next step is implementing an end-to-end interaction platform that turns the contact center from a cost center to a value center. Contact us today to learn more about how we’ve helped other insurance companies reduce their operating costs while improving customer satisfaction.