This post originally appeared on the Finn AI blog. Finn AI is now part of Glia.

Conversational AI—using virtual financial assistants and smart chatbots to engage in intelligent conversations with customers—is becoming one of the most impactful areas in the financial services industry.

A recent study by Juniper Research highlighted the overwhelming operational cost savings gained by using chatbots in banking. The total savings are predicted to reach $7.3 billion globally by 2023, up from just $209 million in 2019.

This represents 862 million hours in time savings—equivalent to nearly half a million working years—and most of this is gained from efficiencies created in customer service processes and workflows.

It’s expected that digital self-service—generally in the form of chatbot integration within the mobile banking app or website—will be the dominant channel for chatbot-driven customer communications, accounting for 79% of successful interactions by 2023.

The wealth of banking insights available to Glia Virtual Assistants has enabled us to build several models to help banks use their own data to prove the value that effective conversational AI chatbots could deliver to their business. Here’s how we did it.

Using Data to Prove ROI

Firstly, Finn AI [now part of Glia] mapped the top 20 call drivers for a mid-sized bank, which capture almost two-thirds of all call traffic. Then, we examined the task completion of each of these drivers and plotted them on a complexity matrix.

How Finn AI Defines Problem Resolution

Generally speaking, Problem resolution is dependent on three things:

- NLP understanding

- Good content

- Solid integrations

For example, a customer enquiring about their bank balance will have a successful transaction with the chatbot as the bot is trained to understand her question (NLP understanding), has the information about her account (good content), and has access to the bank account to perform the query (solid integrations).

However, if that same customer wants to close their account, the chatbot could understand her question (NLP understanding), have the information about her account (good content), but not have the authority or the integration to complete this more complex task. In this case, the chatbot can only complete a percentage of the task before it must hand over to a human.

Once the call drivers and problem resolution rates are mapped, Finn can conduct an ROI analysis to show how much value conversational AI banking can deliver in a digital self-service scenario. Generally, this ROI comes from two areas:

- Deflecting bank call center traffic

- Reducing bank call center employee attrition

An average mid-size bank can save over $1M per year today with banking chatbots

It’s expected that by 2022, up to 80% of common customer service inquiries will be deflected to chatbots, decreasing banking interaction costs by an average of 70 cents per interaction.

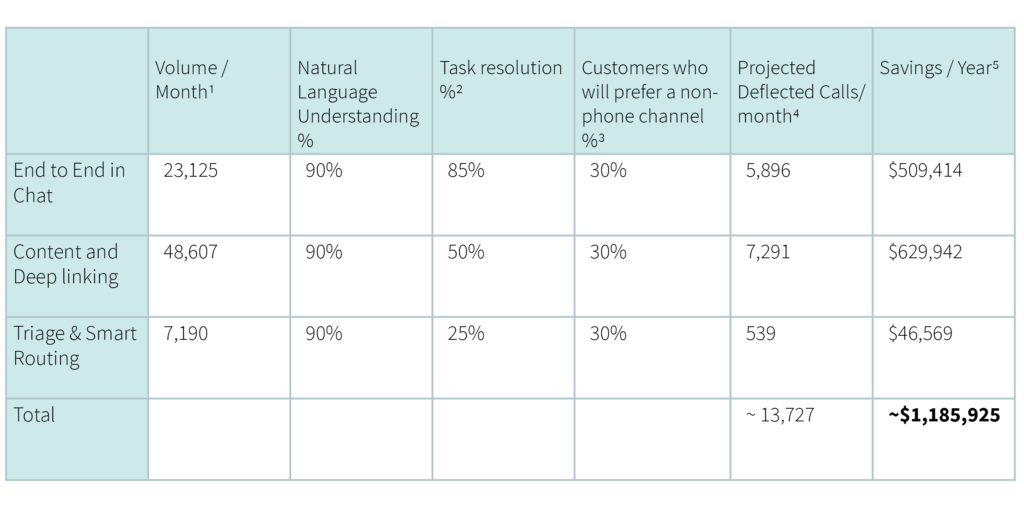

Finn estimates that an average call to a bank contact center costs $7.20. By plotting the volume of engagements received by a mid-sized bank, and factoring in the task completion rates and the percentage of customers that will prefer digital channels, we can estimate the cost savings per year across three categories:

- End to end in chat (leveraging API’s)

- Content and deep linking

- Triage and smart routing

These estimates are conservative and show a saving of at least $1.1 million per year for an average mid-sized bank with 500,000 customers. Savings can easily reach $2 million with more API integrations enabling more end to end in chat experiences.

1 Based on-call driver study conducted in 2017

2 Based on internal Finn AI study of task completion on Finn AI user goals

3 Based on the Bain Report, Bank Branch and Call Center Traffic Jam

4 Formula: Volume/Month x Task Completion % x 30%

5 Formula: Projected Deflected Calls x Cost Per Call of $7.20 x 12 months

Reducing Call Center Employee Attrition

Not only is customer service one of the most costly and inefficient units in a bank, but it is also the unit with the most employee turnover. One key reason for this attrition is employee frustration and/or boredom. Most of the time, employees are answering the same questions over and over again—around 80% of the questions that customer service reps get each day are repetitive questions.

Banking chatbots are a perfect solution to help deflect and triage repetitive customer support inquiries—freeing up time for humans to spend on more productive and enjoyable tasks such as complex problem solving, critical thinking, and creativity (the top three skills deemed essential by the World Economic Forum). Employees can up-skill, move away from repetitive tasks, and feel they are contributing something greater to the business.

AI frees up time for humans to spend on more productive tasks such as complex problem solving, critical thinking, and creativity.

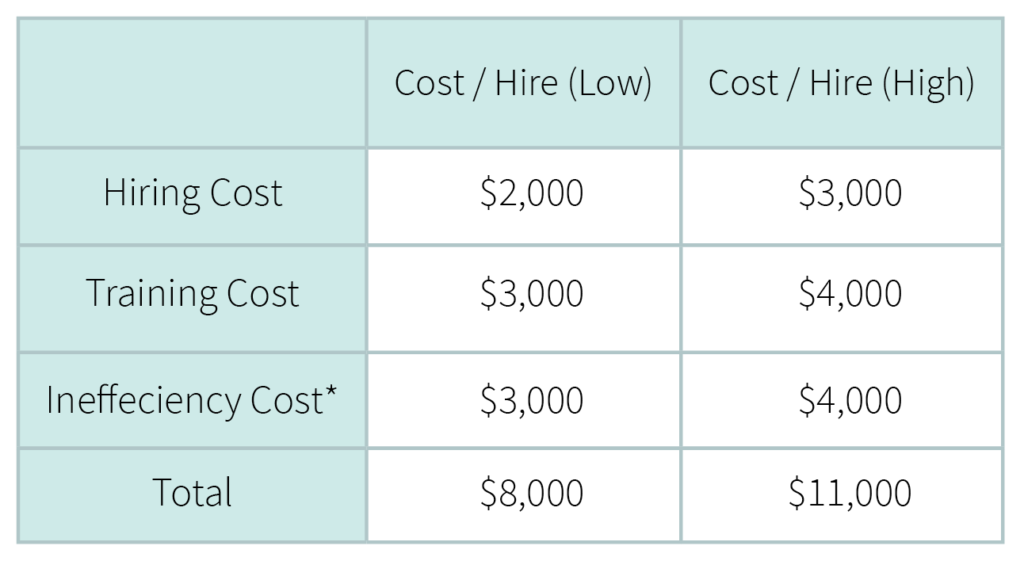

Finn AI [now Glia] estimates that mid-sized banks could save up to $11,000 per customer service employee by implementing a banking chatbot. These costs come from savings in hiring, training, and creating efficiencies in customer service workflows.

Again these numbers are conservative—studies indicate that the typical customer service team will spend $4,000 on a new-hire, and more than $4,800 for training. Despite this investment, 70 percent of customer service workers will quit their jobs within one year.

Conversational AI ROI is Easier to Achieve than Ever

In the past, banks had to spend millions of dollars just to get some very basic Conversational AI features to work effectively. This cost was a huge barrier to entry for all but the largest banking organizations.

Glia has been able to lower the cost of entry for banks of all sizes. By consolidating and fine-tuning the infrastructure and standardizing the deployments, Glia has created efficiencies to reduce the per-unit cost. Furthermore, the deployments are automated which drastically reduces the resources required on the customer side.

We are able to get a typical bank started in less than 2 months, the piece that typically takes the most about of lead time for our customers is integrating into their digital channels, back end systems and connecting to their chat ecosystem. To help make this as easy as possible we have pre-built and validated API integration layers that take off the heavy lifting, the actual technical integration work happens in days. However, we know our customers and lining up the internal approvals and any resources take time, so we suggest a crawl, walk, run approach planning out longer lead time for integration work.

Given the potential cost savings, conversational AI banking can deliver in customer service alone, if you haven’t started your banking chatbot journey, the timing is perfect right now.

A reliable fintech partner like Glia can help you navigate the complex world of natural language processing and machine learning, assist with your proof-of-concept, and help you calculate a tailored ROI estimation for your project.

If you’re interested in the ROI models shared in this post and would like to work with our experts to build one for your own organization, please get in touch.