Glia customers share their success stories

As digital transformation continues to ramp up at more financial institutions, and as macroeconomic conditions encourage organizations to get the most out of their digital properties, the Glia Interaction Platform begins to move from a nice-to-have, into a must-have. Having a sophisticated, holistic digital platform that can bring new efficiencies, boost loyalty, and bring down abandonment rates will become increasingly crucial as retaining consumers and maintaining loyal staff is brought into focus.

However, don’t just take our word for it: there are many Glia customers who have come forward to share the numerous benefits that they’ve experienced from utilizing the Glia Interaction Platform. Banks, credit unions, insurance providers, and more have all seen measurable value from embracing a holistic digital service platform. Read on to hear from a select few of these customers, and learn about the many ways that Glia has allowed them to achieve truly valuable success.

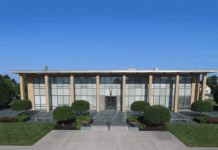

Southwest National Bank

Southwest National Bank is a mid-sized community bank headquartered in Wichita, Kansas that was looking to adopt a new digital platform to help mitigate the large call volumes that they were receiving on a daily basis. Southwest recognized that a lot of these phone calls were for routine, repetitive topics (like requiring help logging-in or with loan payments) that they receive countless times per day, and wanted to identify a way to quickly handle these often repeated conversations.

“Looking at how many phone calls we were taking, and these are the same phone calls we were taking every day, and it’s for these questions we’re answering all the time. So how can we get ahead of that?”

– Kerry Selby, SVP Digital Banking, Southwest National Bank

Southwest Bank wanted to ensure their service reps had access to efficiencies that would allow them to handle this volume of calls easily and swiftly. By empowering their contact center with a unified platform for everything from automation, to text-based chat, and phone support, Southwest can allow their reps to handle more calls in less time.

“The idea that we could have something that is all together—all one platform—[where] the operators only need to know how to use one thing, I mean, that is a game changer.”

– Kerry Selby

Experian Insurance Services

Experian Insurance Services, a broker that works with over 40 different insurance providers, was looking to both improve the customer experience as well as boost online conversions. By utilizing Glia’s ability to intelligently detect where a user is during the application process and proactively reach out for assistance when they’re most likely to need it, Experian is able to ensure that less applications get abandoned before completion.

Experian also takes advantage of Glia’s seamless transitions between channels to increase conversion. They discovered that while many customers may start out with a chat window as they figure the issue will be simple, this can quickly escalate and switching to voice or video will be necessary. Allowing for that transition to occur seamlessly, without requiring the user to actively switch channels, lowers effort and removes an opportunity for the customer to potentially give up and abandon the interaction.

“The key thing that we’ve learned is just being there for our customers to engage the way that they want, so if they want to talk on the phone, we’ll give them the phone option. And if they want to chat with us, we’ll chat with them. We just really want to make sure we’re providing them what they need, when they need it, and how they need it.”

– Kristen Main, Director of Agency Operations, Experian Insurance Services

Direct Federal Credit Union

Direct FCU is a community chartered credit union that serves the Norfolk and Middlesex counties of Massachusetts, and one of the fastest growing credit unions in the state. They utilized a live chat platform with CoBrowsing capabilities to achieve impressive results in both their member experience as well as containing traffic that would have otherwise gone to their call center, allowing them to be more efficient and effective.

“We are already seeing tremendous results and are looking forward to expanding that digital channel. We have had a 94% satisfaction score and 64% of survey respondents stated that they would have called if the chat service was unavailable.”

– Kassandra Martin, Brand and Digital Strategy Manager, Direct FCU

Taking advantage of Glia’s WhiteGlove Service team, Direct FCU was able to fully optimize their Glia Interaction Platform to make use of all its various capabilities. Extensive reporting allowed their team to identify trends in their contact center traffic and make changes or improvements accordingly, all assisted by Glia’s own customer success team.