Insurance has long been considered a relationship business: Relationships between independent insurance agents and their clients, as well as relationships between producers and the carriers they’re appointed with.

It’s also a business that has heavily relied on emails and phone calls to broker those relationships, but times are changing—we live in a digital-first world now. To better understand how agent and carrier interactions are evolving amid the industry’s digital transformation, Glia asked independent agents to share their insights.

We surveyed more than 500 P&C independent agents to learn more about how interactions are happening today and whether that differs from the way agents would prefer to interact with carriers. View the report.

Across all agents surveyed, we identified a disconnect in the channels being offered and what agents prefer. Despite nearly all agents leveraging phone and email today, when asked what channels they’d prefer to use, 35% of agents did not select phone and email.

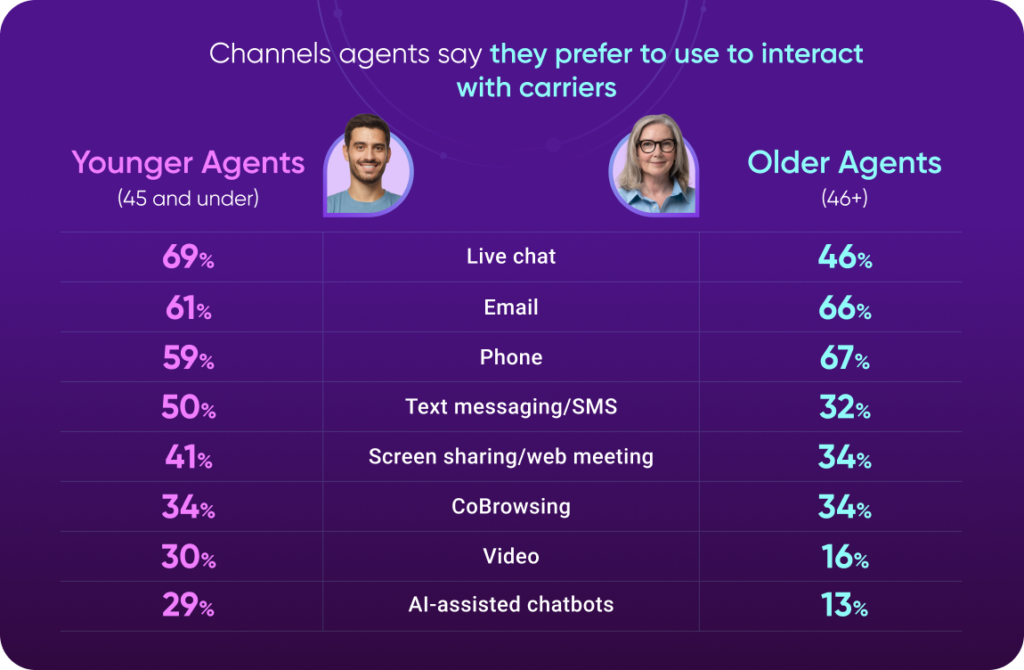

What was particularly interesting, though, was how that data changed when we compared responses from agents 45 and under to the responses of agents 46 and older.

Younger Insurance Agents Are Challenging Traditions

While many younger agents report not having access to chat today with some of the carriers they work with, agents 45 and under rated live chat as their No. 1 preferred channel for interactions with their insurance company partners. Among all younger agents surveyed, 69% selected live chat as a preferred channel, compared to 46% of older agents.

Older agents, who have relied on phone and email as their primary interaction channels for many years, expressed a preference to continue leveraging those channels. In the chart below, you can see what each demographic of agents selected as their preferred channels of communication with carriers.

As you can see, younger agents expressed a stronger preference for all digital-first channels when compared to older agents (with the exception of CoBrowsing, which was 34% for both demographics).

The younger demographic of agents—individuals who have grown up with digital technology at their fingertips—are accustomed to doing business online. Odds are that when these agents are interacting with businesses in their personal lives, they’re already leveraging these digital channels. They’ve been exposed to it by other industries, and they’re now expecting the same from the insurers they’re doing business with.

As the older demographic of agents ages out of the workforce, aligning the agent experience to meet newer expectations will be critical to the success of carriers who distribute through independent agents.

How Carriers Should Be Thinking About Their Support Experience

Consider that 79% of agents surveyed indicated they’re already on a carrier’s portal when they need assistance. With the overwhelming majority of producers online when they need assistance, it makes sense to offer digital-first support channels such as live chat, video, and CoBrowsing.

The need to offer digital channels has traditionally been solved by bolting on a new channel, such as chat. The trouble is, this approach results in siloed systems that don’t talk to each other. A carrier may have one team managing chat while another answers phone calls, and when someone needs to switch channels, they’re forced to restart their interaction all over again with a new support rep.

The Glia Interaction Platform solves for this challenge, and many others, with its ChannelLess™ Architecture, enabling seamless transitions between all digital channels, phone, and AI. With Glia, insurers can provide the support experience independent agents are seeking from carriers by offering digital customer service channels directly within the carrier portal.

Agents can chat, talk over digital audio or video, and leverage screen sharing and CoBrowsing functionality to more quickly resolve their needs. When asked what factors have the greatest influence on where they place their clients’ business, younger agents rated “ease of doing business” as the top factor, even above the price of the policy.

These younger producers are in the growth phase of their careers, and they’re looking to bring more business to the carriers that provide the best experience. Insurance is still a relationship business, but the way agents want those relationships to build and grow is rapidly evolving.

Carriers have an opportunity to differentiate themselves by aligning their service to what agents prefer.

To see the full results of our survey of 522 independent P&C agents, download the report here.