Personalized digital service puts members first and delivers strong ROI

About Community First Credit Union

People

160,000+ members

Assets

$2.5B+ in assets under

management

Locations

19 branches serving people who work or live in Florida’s First Coast region

Challenges

Solutions

Maintain high-touch, human

connections through digital

channels

Developed a human-centric digital strategy to serve members online with an emphasis on live, real-time connections

Accelerate sales/loans

through highly personal

member guidance

Prioritized conversations and member relationships over call deflection and handle time strategies

Adapt to members’ digital

lifestyles with a dynamic

engagement platform

Simplified the online loan process, greatly accelerating the loan cycle

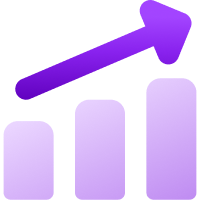

Results

2x+

increase in loans converted

9x

increase in proactive engagements

36%

increase in sales

Community First Means Putting Members First

Making the member experience the top priority is so central to everything Community First Credit Union does, it’s even reflected within its name. Serving more than 160,000 members across Northeast Florida’s First Coast, Community First has grown from a humble teachers’ credit union in 1935 to one of Florida’s largest financial institutions today.

Putting members first has fueled that growth for decades. As digital solutions become central to the credit union experience, the challenge has been to maintain Community First’s high-touch, personal service for remote members who are connecting online.

“Because the Glia platform is easy to use, we can add new use cases, experiment with new ideas and find new ways to grow our interactions. It’s not laborious.”

–Laura Lobetti, Digital Experience Manager, Community First Credit Union.

Human Connection, Not Deflection

Community First took a human-centric approach to digitally transforming its member services. The credit union focused its strategy on how digital channels could enable better ways to connect with members over strategies to deflect phone calls.

A chat solution alone was not going to provide the rich, personal engagement that Community First wanted for its online member experience. Adding separate chat, video and CoBrowsing apps would only create a disparate system that makes online connections complicated and even confusing.

Proactive Guidance Accelerates Loans Process

The Glia platform provides Community First with OnScreen collaboration tools that streamline digital processes. Live Observation, for example, allows service representatives to see the same screen as a member within the Community First website and quickly understand how best to provide support. This allows service reps to proactively reach out and offer guidance for loans. Asking if a member would like help with the application as they are reviewing the auto loan page, for example.

CoBrowsing gets even more proactive. With a member’s consent, reps can help them navigate the site, find online resources and even fill out applications. This accelerates the loan process for members while reducing the abandonment rate and driving up conversions. Community First immediately saw results from this proactive approach, helping it to significantly grow its loan business.

Glia’s Proven Member Engagement Platform

Community First explored solutions that could provide the full range of digital channels, allowing members to choose how they connect and enabling them to transition between channels without disrupting the member experience. After evaluating a number of solutions, Community First chose Glia for its mature Digital Customer Service (DCS) platform, providing seamless member engagements across all channels.

Community First deployed Glia to support online and mobile banking, digital sales and its express team, focused on loan origination. The credit union goes the extra mile to personalize digital service.

“We really emphasize the human touch in our digital service. We even put a selfie image of each representative right into the engagement bubble to reinforce that. We see our members responding to this human connection in our survey feedback. They really connect with that person on the other end. They are using a digital channel and might not even see the representative, but they connected in that engagement for one-to-one member service,” said Laura Lobetti, Digital Experience Manager, Community First Credit Union.

DCS Fuels Rapid Growth

In its first year using Glia, Community First has seen a dramatic 9-fold increase in proactive engagements, with loans more than doubling over the previous year. In fact, the credit union’s total loans grew by 7% in that period with a record amount loaned to consumers, homeowners and businesses. Fueled in part by its strong loan business, Community First reported 17.3% growth in 2021. Community First attributes the impressive digital results to its sharp focus on a personalized member experience. Its high member satisfaction rating underscores that and continues to drive new opportunities for the credit union.