Single interaction platform streamlines service options, enables seamless experience

About Bank of Guam

Assets

$2.65 billion in assets under management

Locations

16 Branches

Region

Serving customers across the Western Pacific Region

“Where you would think that combining the call center and digital service teams would add more complexities, it actually streamlined our service. That’s in part due to the ease of use of the Glia solution and also the clear data we have to see and learn from over time. Our customer service team is more engaged and more accountable, leading to a greater sense of accomplishment and ultimately, a better experience for our customers,” — Kyle Aguon, AVP/Familia Contact Center Manager, Bank of Guam.

Challenges

Provide digital-first options that align to evolving customer expectations

Update legacy phone system with a modern call center

Extend service with automated 24/7 self-service options

Improve the overall customer experience

Solutions

Glia delivers a seamless customer experience across chat and OnScreen voice with collaboration and CoBrowsing capabilities

Bank of Guam maintains its high-level service for customers who prefer to call in via phone

Bank of Guam delivers automated self-service options with chatbot Cara for 24/7 service

The Glia Interaction Platform pre-integrates digital, phone and automated service for unified management, staffing and reporting

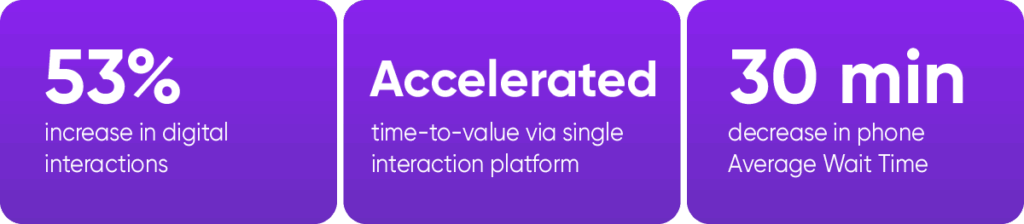

Results

53%

increase in digital interactions

Accelerated

time-to-value via single interaction platform

30min

decrease in phone Average Wait Time

Putting the Customer Experience First

As it celebrated 50 successful years in business in 2022, Bank of Guam was already planning for the next half century. Affectionately called ‘The People’s Bank,’ the institution embarked on a digital transformation of the customer experience that included a call center upgrade, digital-first options, and automated self-service functionality.

“We noticed the patterns of our customers were changing, with a growing demand for online services. In addition to feedback through our front-line support teams, the digital shift was showing up clearly through our Voice of the Customer program. To maintain the service differentiation we’ve built over the past 50 years, we knew we had to keep innovating and launched the Digital Customer Experience Project to align with customer expectations,” said Edward Barcinas, VP/Director of Customer Experience, Bank of Guam.

Bank of Guam was already exploring digital service solutions when the pandemic hit, adding a new sense of urgency. While the bank knew it had to act quickly, it also understood that it had to get the technology right to deliver a high level of service. Rather than a stop-gap fix during a challenging period, the Digital Customer Experience Project focused on a flexible foundation that would meet customer needs today as well as tomorrow—even as preferences shift.

As the project team explored solutions, it closely assessed which vendors prioritize the customer experience. In addition to a strong track record in helping financial institutions digitally transform the customer experience, Glia stood out by taking time to understand Bank of Guam’s culture and its drive to deliver an exceptional customer experience.

“Glia was fresh and well designed, making it simple for us to deploy, train our teams and maintain great service for our customers. Plus the Glia team asked the right questions to better understand our business from our KPIs to our future plans,” said Barcinas.

The Single Platform Advantage

Bank of Guam had three major initiatives as part of its customer experience transformation, including digital, phone, and automated self-service options. Initially interested in Glia for its Digital Customer Service (DCS) capabilities, the bank took a closer look at Glia Call Center as well as Glia’s automation capabilities including its AI Management framework.

With the unified Glia Interaction Platform, Bank of Guam has realized numerous benefits, including pre-integration of all solutions from a single vendor as opposed to making three disparate solutions work together. This has resulted in significant savings in both cost and time while allowing the bank to roll out the Digital Customer Experience Project with confidence that the call center, Digital Customer Service and automated self-service solutions would work seamlessly as one.

To maintain traditional phone support, Bank of Guam upgraded its system with Glia Call Center as it deployed Digital Customer Service to offer on-screen chat and voice. This allowed, Bank of Guam to offer digital-first service as well as phone support for customers who still prefer to call in.

Automated self-service was another crucial component of the Digital Customer Experience Project. Seeking to provide 24/7 support, Bank of Guam developed a chatbot. Called Cara, the virtual assistant can help customers after hours and also handle routine questions. Cara has been a highly effective solution for the bank, helping to lower both the average wait time and average handle time, while enabling self-service for customers that seek it. In fact, 76% of all chats are now handled through the Cara virtual assistant, with only 14% requiring assistance from a live representative. Customers are seamlessly connected when they do require live assistance. This has helped the service team become more strategic, with more time to tackle unique and challenging customer inquiries.

More Efficient Employee Experience

Glia’s unified platform has helped to further improve Bank of Guam’s employee experience as well. Rather than separate units for the call center and for digital support, the bank was able to move to a single customer service team. The simplicity of the Glia Interaction Platform allows representatives to quickly train on one platform and start providing support almost immediately. This overcomes staffing challenges while creating new efficiencies.

Further, the data advantage of having all interactions consolidated on one platform has allowed Bank of Guam to understand trends quicker and manage customer service in near real time. With clear data, the bank is able to help the customer service representatives understand how they are measured, which has led to greater accountability.

“Where you would think that combining the call center and digital service teams would add more complexities, it actually streamlined our service. That’s in part due to the ease of use of the Glia solution and also the clear data we have to see and learn from over time. Our customer service team is more engaged and more accountable, leading to a greater sense of accomplishment and ultimately, a better experience for our customers,” said Kyle Aguon, AVP/Familia Contact Center Manager, Bank of Guam.

The Platform to Learn and Grow

The consolidated interaction data is providing Bank of Guam with deep insight into its business, with the ability to assess and act quicker than before. Prior, the bank was pulling reports from several disparate systems. Further, the data didn’t always correspond, creating challenges in understanding the full customer experience across phone, digital, and AI-automated channels. Now Bank of Guam has live data, which is easier to understand, share, and act upon.