Artificial Intelligence (AI) is becoming more and more expected in financial services. Banks, credit unions, and other financial institutions are adopting the technology at a rapid pace; For many, AI adoption isn’t a question of ‘if’, but ‘how’ and ‘when’.

According to The Economist, 85% of IT executives in banking have a clear plan for adopting AI in the development of their future products and services. AI virtual agents are one of the earliest steps that many financial institutions will take towards developing their AI platforms, being one of the most common and widespread applications. AI virtual agents are customer-facing chatbots designed to help navigate users through digital platforms, answer questions, and reroute customers to human agents at times of need.

Read on to see more of the benefits of intelligent virtual assistants in banking, some important considerations, and where you can find a purpose-built AI assistant that’s built just for the financial industry.

Boosting Customer Service with AI Virtual Agents

Intelligent virtual agents are cropping up across all of the banking industry for a good reason: For many institutions, they’re seeing some great gains in customer experience, efficiency, and cost savings as a result:

- Customer Experience is improved as users have access to 24/7 support, providing them with an easy self-service opportunity whenever they need it. An AI assistant can cut down on time spent searching through your website for an answer to their question, and avoid them needing to call in and ask one of your human representatives when the customer would rather answer it themselves.

- Efficiency sees gains as customers have a way to access help for their simple, repetitive inquiries without needing to reach out to a live agent. The AI agent can answer these questions, and pass along more crucial needs to your human representatives for when the human touch is important. Now, your agents will be able to spend more time handling these important needs.

- Cost Savings come from the hours saved by your employees no longer needing to answer every inquiry that comes their way. With a significant portion of customer questions able to now be automated, high call volumes can be reduced and billable hours can be saved. One credit union, for instance, saved approximately $41,600 per month with the help of an AI virtual assistant.

With all these possible benefits, and more, of an AI virtual agent implementation, it’s no surprise that so many financial institutions are eager to implement one of their own. But before you immediately go looking for an AI to call your own, there are a few things you might want to consider beforehand.

Where AI Agents Can Go Wrong

Not all bots are built equal: while there are plenty of good solutions out there, there are also plenty of poor quality AI virtual agents on the market that will end up doing more harm than good. Here are a few things to keep in mind when looking through vendors to find your perfect AI solution:

- Poorly Implemented Bots can cause a good deal of frustration for users, leading to a worse customer experience than if they weren’t ever there. Some chatbots simply aren’t built for the needs of the financial industry, or rely on outdated or poorly functioning architecture. There are many ways a chatbot can fail a user, leading to a service experience that leaves users wishing they could have just spoken to a human rather than enjoying the convenience of AI.

- Generative AI is a new and exciting development in the world of AI, but when not treated with the proper care and respect the results can be disastrous. AI virtual agents that run off of generative AI have the potential to cause rogue responses, information leaks, and breaches of trust between consumers and their bank. Responsible AI must be deployed to get the benefits of this technology without any harmful drawbacks.

- Do-it-Yourself Kits may seem like a thrifty way to get your own AI solution, but the drawbacks of needing to spend precious time, resources, and effort on training and developing this chatbot will far outweigh the benefits. A solution not pre-made for the needs of the financial industry won’t have a lot of the functionality that you’re looking for in a potential AI virtual agent.

With these considerations in mind, those looking for success with AI assistants should be looking for a proven AI solution that’s been purpose-built for the financial industry, and built on a responsible AI architecture. It should have measurable and demonstrable value within the banking industry, made with security and compliance needs in mind, and comes ready to hit the ground running with winning results.

Glia Virtual Assistants: AI Agents Made for Banking

Luckily, there’s an option out there for financial institutions looking for a pre-made AI virtual agent for their industry: The Glia Virtual Assistant (GVA) is the only AI solution made specifically for the needs of the financial industry. Pre-trained on over 800 different common banking questions, it comes prepared out-of-the-box to start helping your customers fast for instant results. There’s a lot going for the GVA that sets it apart from the rest:

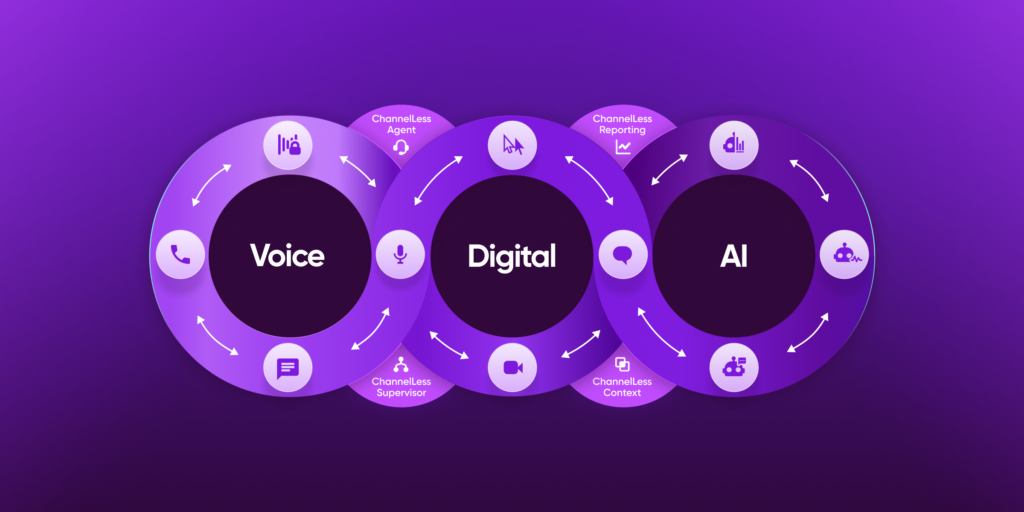

- ChannelLess® design means that the GVA can help your users across both text-based chats and dial-in phone calls simultaneously. As part of a complete Unified Interaction Management platform, your virtual AI agent across every channel can be easily accessed and managed from one singular point, lowering complexity and increasing ease of use.

- Responsible AI is one of the founding principles of the GVA, which utilizes generative AI tools in a safe, proven, and reliable way. It’s purpose-built for the security and functionality needs of the financial industry, and with a proven track record of success you can trust that it will provide genuine benefits.

- Pre-built AI means you won’t have to be an AI expert or dedicate a lot of time and resources to training and setting it up. This AI virtual agent comes pre-loaded with all the functionality a bank or credit union will need, ready to help from the word go.

AI virtual agents truly do seem like the future standard for self-service options that a financial institution can offer, and as they become more ubiquitous across the industry then the expectation for others to adopt them rises. When you’re ready to join along with the industry’s movement towards AI tools, make sure you get it right the first time with a responsible AI virtual agent that’s made just for your business.

Check out some more information about the GVA. Ready to see it in action? Book a meeting with us and we’ll give you a live demonstration.