Most business owners know improving customer experience (CX) can reap rewards like higher revenues, increased customer retention and more new clients. However, according to a global survey by the firm Forrester, only 1 in 5 businesses use the information they gather about CX to explain why their businesses fail or succeed in areas like customer retention. That is a huge missed opportunity.

When companies make an effort to measure customer service impact, they not only improve service but save money. Take Sprint, for instance, which saved more than $1.7 billion in outsourced calls and customer credits after it addressed the main reasons of customer service complaints–which ranged from hard-to-use interactive voice response systems to a complicated process for getting rebates on phones. (The company identified about 40 items to fix.) The wireless carrier’s revamped attention to its clients springboarded the company from being rated last in the American Customer Satisfaction Index to first.

Companies rely on a number of metrics to measure CX success. Many use the net promoter score (NPS), which has customers rate how likely they’d recommend a brand to a friend on a scale from zero to 10. The more people who say they are extremely likely to suggest a brand to someone, the higher the score. Furthermore, those enthusiastic promoters give the brand repeat business and refer more customers to the company, both vital services. While NPS may be a decent starting point for understanding customer experience at a particular firm, the score falls short in addressing the complexity involved in how a company can improve. These are a handful of ways to measure CX success, beyond NPS.

1. SERVQUAL

Marketing expert A. Parasuraman saw his studies in practice when staying at a hotel that presented him with a menu listing nine different pillows he could choose to sleep on. Impressed, he immediately raised his expectations for his visit, but was soon disappointed as the hotel botched basic services like failing to provide a promised wake-up call.

Much like the hotel’s unexpected poor service frustrated Parasuraman, SERVQUAL measures the gap between customers’ expectations versus a brand’s reality. Developed in the late 1970s, the measure moves beyond the simpler methods of NPS to help companies get a more holistic idea on how they’re doing by surveying both the company and its customers on a number of factors. SERVQUAL, short for service quality, tracks 21 factors that influence customer experiences that fit into the following categories: a company’s responsiveness in helping customers; reliability in providing a dependable service; assurance that employees are skilled and trustworthy; empathy shown by individualized attention to the customer; and tangibles like the look of the company’s physical facilities and equipment. Using surveys to collect its data, SERVQUAL research requires customers to prioritize the factors that matter most to them, as to direct companies to focus more on those individualized factors.

The takeaway: Actual customer expectations don’t always align with what we perceive. We can use SERVQUAL to get a better grasp on these expectations, so we focus on what matters to the customer. Getting into your customers’ brains and understanding their motivations are key.

Furthermore, the metric lets us know what features we should put on the back burner, such as a hotel’s pillow menu, which saves money by cutting unnecessary components. We recall Parasuraman felt even more let down with the hotel’s subpar service than he would’ve been otherwise because the menu had raised his expectations. Similarly, companies get a shot of perspective when they learn that features they view as new and exciting actually might need to get pushed off to make way for more pressing concerns.

2. Customer Satisfaction Index

For the first time in two decades, satisfaction with the airline industry is back at an all-time-high, with new planes, in-flight snacks and free snacks driving the surge. The American Customer Satisfaction Index (ACSI) is responsible for rating specific aspects about CX such as those from a scale of zero to 100, which provides brands with a consistent gauge for customer satisfaction that spans across industries. Developed in 1994 by University of Michigan researchers, the ACSI provides specific guidance on how companies can improve–unlike NPS, which doesn’t address why customers surveyed answered how they did.

Each year, ACSI tracks the responses of more than 70,000 customers. Companies measured can get an idea about customer satisfaction with their own companies, as well as others in their industry. Particularly for those who want to predict their success in the stock market, the price-adjusted ACSI is ideal for tracking the changes in a company’s performance over time. Companies that want to track the effects of resolving customer complaints, however, might benefit from using another measure. The ACSI figures the impact of complaints on customer satisfaction, but not their resolution.

The takeaway: Because ACSI and other variations are so widely used, we can take notes from a variety of industries about best CX practices, especially with so much information readily available online. Airlines, for instance, score very low in ACSI measures in how they handle complaints. They can use that info to drive efforts to increase response times, which now take several weeks rather than an hour. By asking customers about a variety of CX factors, a customer satisfaction index can explain behavioral measures, like purchases, more holistically than NPS, which relies on just one answer to a simple question.

3. Wallet Allocation Rule

Walmart learned firsthand the pain of the wallet allocation rule back in 2009 after spearheading a company-wide remodel of its stores. In response to widespread customer feedback, the corporation spent more than $1.8 billion in making its shelving and endcap displays less cluttered, as well as reworking its logo.

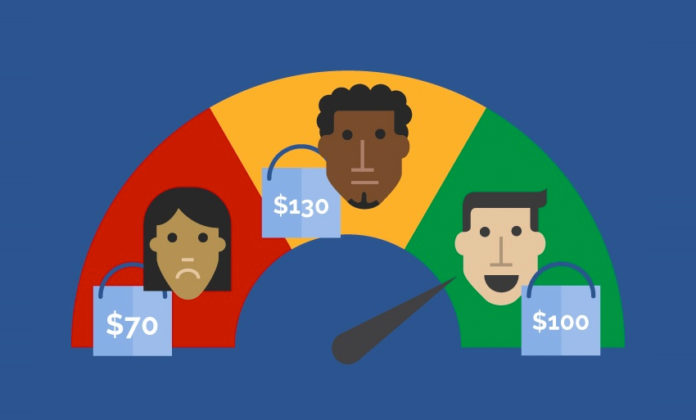

U.S. sales at Walmart went down, while sales at other discount chains like Dollar Stores and Target went up. While NPS focuses on customer loyalty,the newly developed wallet allocation rule relies on customers ranking a brand in relation to its competitors. Some analysts consider the rule as the next big breakthrough in examining customer thinking. After all, it matters less if customers continue to have loyalty to your brand if they are frequenting your competitors, and losing you sales.

The wallet allocation rule goes beyond asking customers if they’re happy with their experience to ranking the company as their first, second or third choice compared with its competitors. Companies gather data using questionnaires and other strategies to calculate what customers spend on similar products or services and how many customers also patronize competitors. They then survey customers on what attracts them to their competitors and work on improving those aspects in their own businesses.

The takeaway: CX success relies on a range of other factors beyond customer loyalty. The wallet allocation rule reminds us a brand’s CX performance doesn’t happen in a vacuum, and customers have a range of competitors to choose instead. If you aren’t leading the ranks with your brand, you should ask customers why they prefer your competitor instead, via quantitative surveys, and change accordingly to improve your positioning.

Combined, these methods are just a start to measuring CX success. Each have its strengths. Used alone in a siloed approach, these metrics can fail to address what exactly is wrong with companies’ customer service. However, pairing these approaches with specific questions about why customers answered the way they did can result in more defined areas of improvement for true CX success.